The Capital One Venture X Rewards Credit Card is an excellent choice for military service members and their families, offering a healthy welcome bonus opportunity, robust rewards, exceptional travel perks, and military-specific protections.

When applying, it’s important to understand the differences between the Servicemembers Civil Relief Act (SCRA) and the Military Lending Act (MLA) regarding fee waivers.

While Capital One waives the annual_fees annual fee of the Venture X Rewards Card for eligible service members under the SCRA, it is not waived under the MLA. More on that below.

Despite this, the card’s travel rewards, experience credits, and other perks make it a valuable option for military members and their families.

View the simple application process here to take advantage of the card_name benefits today.

Capital One Venture X Military Benefits and Rewards

Product Name: Capital One Venture X Rewards Credit Card

Product Description: The Venture X Rewards Credit Card is a premium travel rewards card offering 2X miles on all purchases, up to 10X miles on travel booked through Capital One Travel, and a range of luxury travel perks for a relatively low annual fee.

Likelihood of Continuing Use

Recommend to a Friend/Colleague

Summary

- Get a generous welcome bonus: bonus_miles_full.

- Earn 10X miles on hotels and rental cars booked through Capital One Travel.

- Flights booked through Capital One Travel earn you 5X miles.

- Earn 2X miles on all other purchases, with no limits or category restrictions.

- Get a $300 annual travel credit for bookings made through Capital One Travel.

- Receive a fabulous anniversary bonus of 10,000 miles every year starting on the first anniversary, worth $100 towards travel.

- Receive up to a $100 credit for Global Entry or TSA PreCheck®.

- Gain unlimited access to Capital One Lounges and 1,300+ Priority Pass lounges worldwide for you and up to two guests per visit.

- Have peace of mind with cellphone protection, covering up to $800 per claim when you pay your monthly bill with the card, with a maximum of two claims per year.

- Stay covered with trip cancellation and interruption coverage for qualifying events.

- Enjoy 90 days of return protection on eligible purchases and extended warranty protection on eligible items purchased with the card.

- Benefit from travel accident insurance when you purchase your travel fare with the card.

- Relax with an auto rental collision damage waiver for eligible vehicle rentals.

- Access the Visa Infinite concierge service for assistance with reservations, tickets, and more.

- Enjoy a complimentary PRIOR subscription, providing access to curated travel experiences and insider information.

- With a discounted membership to The Cultivist, you can visit select museums worldwide for free, and you can also access Capital One Entertainment for exclusive tickets and VIP event access.

- Indulge in culinary events and hard-to-get reservations at top restaurants with Capital One Dining.

- Enjoy the benefits while paying a $395 annual fee (before SCRA benefits).

- See Rates and Fees. Enrollment is required for some benefits.

How to Apply for the Capital One Venture X Rewards Credit Card

To apply for a Capital One Venture X card, first click here or follow the link below and hit “Apply Now.” This will take you to a secure application form.

Next, fill out the online application form. In general, you’ll need to provide:

- Personal Information: Enter your full legal name, home address, phone number, email address, and date of birth.

- Social Security Number: Provide your SSN for the necessary credit check.

- Employment and Income Details: Enter your current employment status, occupation, employer information, and annual gross income.

- Housing Information: Include your monthly rent or mortgage payment.

Continue to the next page to read the credit card’s terms and conditions, then submit your application. This includes the annual fee, interest rates, and any other charges associated with the card. Make sure you understand your responsibilities as a cardholder.

Once you’ve reviewed all the information and terms, submit your application. Capital One will then run a credit check to evaluate your eligibility.

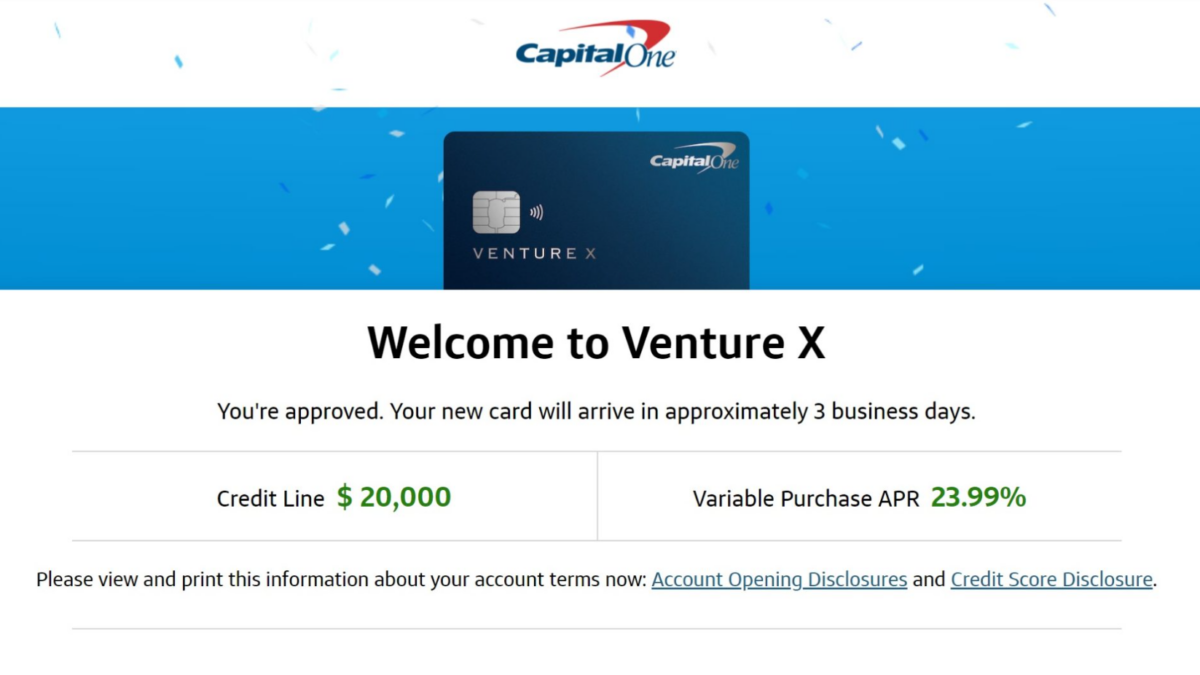

After submitting your application, you should receive an instant decision, including the credit line and variable purchase APR of your card, if approved. Sometimes, you may need to wait a few days while Capital One reviews your application further. If additional verification is required, you may be contacted for more information.

If approved, you will receive your card_name by mail in as soon as three business days. Along with your card, you will receive information on how to activate it and start using it.

Once you receive your card, activate it by following the instructions provided. You should also set up online access through the Capital One website or mobile app, which will allow you to manage your account, track your rewards, and make payments.

Compare Top Military Credit Cards

Compare the rates, fees, and rewards of top credit cards for military servicemembers and veterans, including cards with waived annual fees under the SCRA.

What Military Relief Does Capital One Offer?

Capital One provides significant protections under the Servicemembers Civil Relief Act (SCRA) for the Venture X card. These benefits are designed to alleviate financial burdens for service members during their service:

- Interest Rate Cap: Capital One lowers the interest rate on the Venture X card to 4% for qualifying service members, which is more generous than the 6% cap mandated by the SCRA. This reduced interest rate applies to balances incurred before you began active duty, helping you manage your debt more effectively.

- Annual Fee Waiver: One of the most valuable benefits under the SCRA is waiving the $395 annual fee for the Venture X card. This fee waiver is available throughout your active duty service, provided you opened the card before entering active duty.

- Waiver of Additional Fees: In addition to the annual fee, Capital One waives other card-related fees, including late and foreign transaction fees, ensuring that your financial obligations remain manageable while you serve.

To qualify for these SCRA benefits, your Venture X card must have been opened before you started active duty. You must also submit a formal request to Capital One to activate these benefits.

Applying for SCRA Benefits

To apply for SCRA benefits with Capital One, follow these steps:

- Visit the Capital One Military Website: Start by visiting the Capital One military website, where you can access the application for SCRA benefits.

- Complete the Application: The application process is straightforward and requires basic information, including your name, phone number, date of birth, Social Security Number, and address.

- Social Security Number Verification: Capital One will run your Social Security Number against the Defense Manpower Data Center’s (DMDC) SCRA database. This database helps verify your active duty status.

- Compare Active Duty Start Date: If there is a positive match in the SCRA database, Capital One will compare your active duty start date against the date you opened your Venture X card. If the card was opened before your active duty start date, you qualify for the annual fee waiver and other SCRA benefits.

Who Should Consider Applying for SCRA Benefits?

If you fall into one of the following categories, you should consider applying for SCRA benefits for your Venture X card:

- Army, Navy, Air Force (including Space Force), Marine Corps, and Coast Guard

- Commissioned officers of the National Oceanic and Atmospheric Administration

- Commissioned officers of the Public Health Service

- U.S. citizens who are members of an allied nation’s military service

- Spouses and dependents of active duty Servicemembers listed above

In addition to those mentioned previously, the following groups should have the ability to open the card, apply for SCRA benefits, and have their annual fees waived while they’re on active duty:

- ROTC Cadets or Midshipmen: If you’re enrolled in ROTC and have already opened a Venture X card before your commissioning or active duty start date.

- Military Academy Cadets or Midshipmen: Cadets or midshipmen at West Point, the Naval Academy, or the Air Force Academy who opened their cards before starting active duty.

- Enlistees: Those about to enlist in the military can open the Venture X card before starting their active duty service to take advantage of SCRA benefits.

- National Guard or Reserves: Members of the National Guard or Reserves who are about to go on 30+ day active orders can also qualify, provided they opened the card before activation.

If you meet these criteria and open the card before starting active duty, Capital One will waive your annual fees during your service and potentially for at least a year or two afterward, depending on the specific terms of your SCRA benefits.

MLA Benefits for the Venture X Card

For credit cards opened during active duty, the Military Lending Act (MLA) provides important, though slightly different, protections:

- Military Annual Percentage Rate (MAPR) Cap: Under the MLA, Capital One ensures that the Military Annual Percentage Rate (MAPR) does not exceed 36%, as required by law. This cap covers all interest and fees associated with the card.

However, it’s important to note that Capital One does not waive the $395 annual fee under the MLA for cards opened during active duty. This contrasts with the SCRA benefits and is a key distinction that service members should know when considering when to apply for the card.

American Express waives annual fees for the military, and Chase cards like the Chase Sapphire Reserve waive the annual fees for both military service members and their spouses.

Pros and Cons of the Capital One Venture X Card for Military Service Members

While Venture X can provide significant value for military service members and their spouses, it still has some important considerations and potential drawbacks.

- Annual Fee Waiver under SCRA: If the card is opened before active duty, the $395 annual fee may be waived under the Servicemembers Civil Relief Act (SCRA), making the card cost-free for eligible service members.

- High Earning Potential: Earn 2 miles per dollar on all purchases and up to 10 miles per dollar on travel booked through Capital One Travel, allowing military members to accumulate rewards quickly.

- $300 Annual Travel Credit: Offset travel costs with a $300 annual credit for bookings through Capital One Travel, which can be a valuable benefit for frequent travelers.

- Airport Lounge Access: Enjoy unlimited complimentary access to over 1,300 airport lounges worldwide, including Capital One Lounges, which can enhance the travel experience for military members and their families.

- Flexible Redemption Options: Miles can be redeemed for travel expenses, transferred to over 15 travel loyalty programs, or used for other redemption options, providing flexibility in how rewards are used.

- No Foreign Transaction Fees: This is ideal for military members stationed overseas or traveling internationally, as there are no foreign transaction fees on purchases made abroad.

- Comprehensive Travel Protections: Includes travel insurance, trip cancellation coverage, and rental car insurance, which are particularly beneficial for military personnel who travel frequently.

- No Annual Fee Waiver under MLA: If the card is opened during active duty, the $395 annual fee is not waived under the Military Lending Act (MLA), which may make the card less appealing for some service members.

- Requirement to Book Through Capital One Travel: Bookings must be made through Capital One Travel to earn the $300 annual travel credit and higher rewards rates, which could be less flexible than other options.

- Limited Lounge Availability: While lounge access is a significant perk, the number of Capital One Lounges is currently limited, potentially reducing the benefit depending on travel destinations.

- High Annual Fee for Non-Eligible Service Members: The $395 annual fee may be a significant drawback for those who do not qualify for the SCRA fee waiver if the card’s benefits are not fully utilized.

- Eligibility Criteria: Requires excellent credit, which may not be accessible to all military members, particularly younger service members or those with limited credit history.

Frequently Asked Questions About the Capital One Venture X Card

Here are some of the most frequently asked questions by the military community for the Venture X card.

Is the Capital One Venture X free for the military?

The card_name is not automatically free for military members. However, if you opened the card before entering active duty, you may qualify for Servicemembers Civil Relief Act (SCRA) benefits, which include the waiver of the $395 annual fee and a cap on interest rates at 4%. If you opened the card while already on active duty, the annual fee is not waived under the Military Lending Act (MLA), though the Military Annual Percentage Rate (MAPR) is capped at 36%.

Is the Capital One Venture X card worth it for active-duty military members?

The card_name is an excellent choice for active-duty military members, especially if you qualify for the Servicemembers Civil Relief Act (SCRA) benefits, which may waive the $395 annual fee if the card was opened before active duty. This alone provides substantial savings. Beyond the fee waiver, the card offers a $300 annual travel credit and unlimited access to over 1,300 airport lounges worldwide, including Capital One Lounges.

The card offers great earning potential, with a minimum of 2 miles per dollar on all purchases and up to 10 miles per dollar on travel booked through Capital One Travel. These miles can be redeemed for travel expenses or transferred to over 15 travel loyalty programs.

According to The Points Guy, the Venture X card’s benefits can easily outweigh the annual fee, offering a potential value of over $1,500 annually for those who maximize its features. For active-duty military members who travel frequently, the Capital One Venture X card is definitely worth considering.

Is Capital One military-friendly?

Yes, Capital One is considered military-friendly and offers various protections and benefits to military members under the SCRA and MLA. They provide a lower-than-required interest rate cap of 4% for service members and waive the annual fee for credit cards, including the Venture X, opened before active duty. However, the waiver of fees under the MLA is not offered for cards opened during active duty, which is something to consider when comparing with other issuers.

What is the interest rate for Capital One’s military cardholders?

For service members who qualify under the SCRA, Capital One offers an interest rate capped at 4% for credit card balances incurred before entering active duty. This is more favorable than the standard 6% cap the SCRA requires. For cards opened during active duty, the Military Lending Act (MLA) ensures that the Military Annual Percentage Rate (MAPR), which includes interest and fees, does not exceed 36%.

How are military spouses with the Venture X card treated by Capital One?

Military spouses who hold a card_name are subject to the same SCRA and MLA protections as service members, provided they are joint account holders or authorized users. If the card was opened before the service member’s active duty, SCRA benefits, including the waiver of the annual fee and a 4% interest rate cap, may apply to the account.

However, if the card was opened during active duty, the annual fee is not waived under the MLA, though the 36% MAPR cap would apply. Military spouses should ensure their status is correctly documented and consider applying for SCRA benefits if they meet the eligibility criteria.

What credit score do I need to qualify for the Capital One Venture X card?

To qualify for the card_name, you typically need an excellent credit score, which is generally considered 720 or higher. Factors such as a strong credit history, low debt-to-income ratio, and a stable income can also improve your chances of approval.

How do I redeem Capital One Venture X rewards miles?

You can redeem your Capital One Venture X rewards miles in several ways:

- Travel Purchases: Use your miles to cover travel expenses like flights, hotels, rental cars, and more through the Capital One Travel portal or by redeeming them as a statement credit for travel purchases.

- Transfer to Travel Partners: Transfer your miles to over 15 partner airline and hotel loyalty programs.

- Gift Cards and Merchandise: Through Capital One’s rewards portal, you can redeem miles for gift cards, merchandise, or other non-travel-related options.

Can I upgrade my existing Capital One card to the Venture X?

Yes, if you already have a Capital One credit card, you may be eligible to upgrade to the Venture X card. However, whether you can upgrade will depend on your account history, creditworthiness, and other factors. Upgrading typically means you’ll retain your existing credit line and account history, which can benefit your credit score.

Does the Capital One Venture X card charge foreign transaction fees?

No, the Capital One Venture X Rewards Credit Card does not charge foreign transaction fees. This makes it an excellent option for frequent travelers who want to avoid extra costs when purchasing abroad or while deployed overseas.

How does the $300 annual travel credit work with the Venture X card?

The card_name offers a $300 annual travel credit, which can be used for bookings made through the Capital One Travel portal. This credit automatically applies to eligible travel purchases, such as flights, hotels, and rental cars, reducing out-of-pocket costs.

What airport lounges can I access with the Venture X card?

As a Capital One Venture X cardholder, you receive unlimited complimentary access to over 1,300 airport lounges worldwide. This includes Capital One Lounges, which offer premium amenities, and lounges in the Partner Lounge Network, such as Priority Pass lounges.